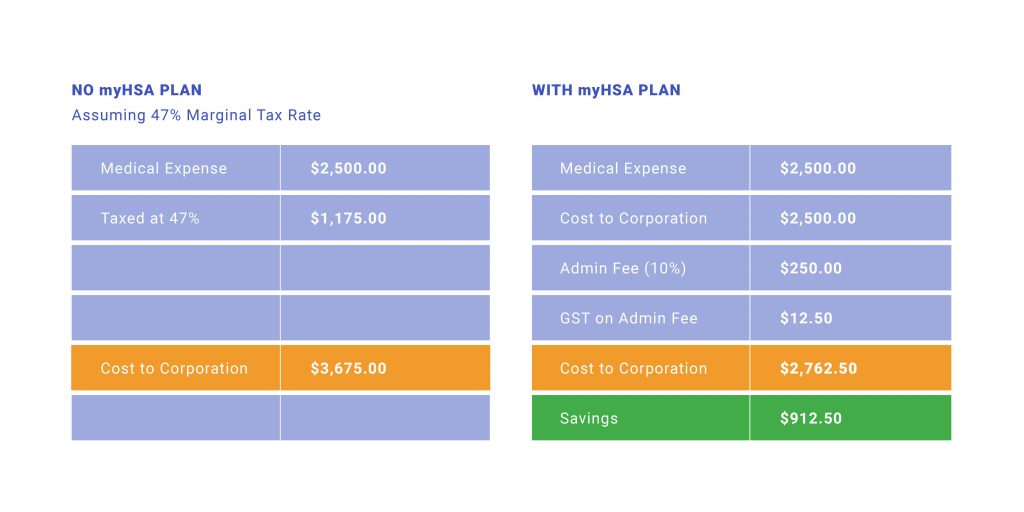

Health Spending Accounts are becoming an increasingly popular benefit offering in Canada. They help make benefits accessible to incorporated business owners and their employees while being tax friendly. Business owners can write off all eligible expenses and use Health Spending Accounts to save taxes on big ticket medical expenses.

If you run your own business or are in the startup stage, a Health Spending Account (also known as an HSA or PHSP) can be a great way to start offering benefits while at the same time, saving you money. The flexibility of an HSA allows you and your employees (or just you), to be reimbursed from many medical and dental expenses, tax free. Additionally, as your business grows and you team becomes larger, an HSA can be integrated into a cost-effective and comprehensive overall benefits plan strategy.

There are a number of advantages to an HSA including ease of use, controllable cost, and dynamic coverage. While an HSA does not replace the need for a fully comprehensive benefits strategy, the advantages make HSA’s ideal for incorporated professionals or early stage businesses.

Benefits of a Health Spending Account:

•Pay-As-You-Go plan

•Comprehensive coverage on medical, dental and vision expenses with few limits

•Reimbursements to employees are not taxable benefits

•No mandatory monthly or annual premiums

•No deductibles

•Online and mobile claims submissions

•CRA Approved

HSA’s can be a great first step to rewarding, attracting, and retaining your employees with benefits while your business grows or taking care of you and your family while saving you money.

Ready To Start?

Whether you are with a business, association, or owner operator, we have the solution for your needs.